Diminishing value method formula

Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is-. This formula is derived from the study of the behavior of.

Double Declining Balance Depreciation Calculator

000 over 100000 miles.

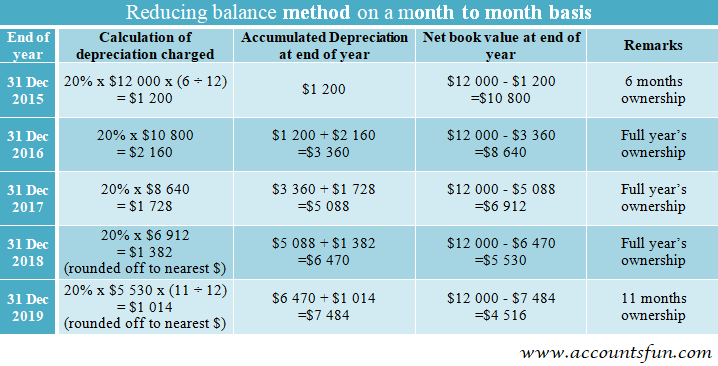

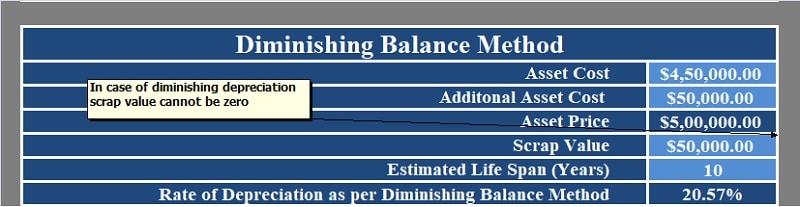

. Then you apply the damage and mileage multipliers. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value.

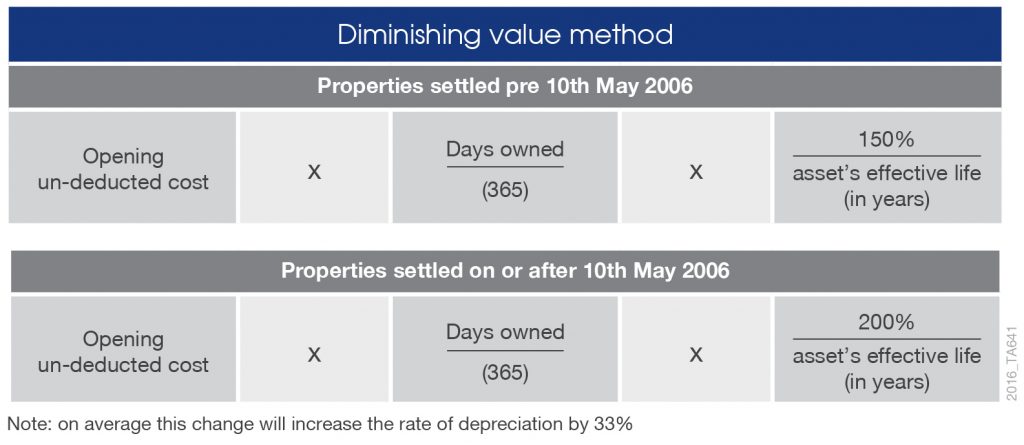

The most widely accepted method for calculating diminished value is the 17c formula. Use the diminishing balance depreciation method to calculate depreciation expenses. The diminishing value method allows for a higher depreciation deduction of the asset in the first years of ownership and then reduces over its effective life using the following.

We already depreciated our car by 600 in the first year. I want to put a formula in the attached sample worksheet as per below requirement. Most insurance providers favor this method but keep in mind that its not universal.

Diminishing Balance Method Example. You might need this in your mathematics class when youre looking at geometric s. This would be applicable for both Straight Line and Diminishing Value depreciation.

Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. Insurance companies are skilled at. Cost value diminishing value rate amount of depreciation to.

However when using this method we calculate depreciation based on the cars current value not original value. And the residual value is. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years.

Prime cost straight line method. As it uses the. Depreciation - 10500 calculated from 1306 300606 - But only 4 months in.

In this video we use the diminishing value method to calculate depreciation. Concept And Accounting of Depreciation Diminishing Balance Method The various methods of depreciation are based on a formula. To determine the diminished value you multiply the vehicle value by the 10 cap.

When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period. Step Two Determine Accurate Amount with Diminished Value Appraisal. If your claim seems feasible then the next step is to proceed with an appraisal.

In the first month of purchase the value will remain the same after this it will. For the first year depreciate using the rate youve identified and the assets cost value how much it cost you to buy.

Straight Line Vs Reducing Balance Depreciation Youtube

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Written Down Value Method Of Depreciation Calculation

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

Depreciation Formula Examples With Excel Template

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Depreciation Formula Calculate Depreciation Expense

Diminishing Value Vs The Prime Cost Method By Mortgage House

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Written Down Value Method Of Depreciation Calculation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Calculate Rate Of Depreciation For Diminishing Balance Otosection

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Written Down Value Method Of Depreciation Calculation